Middle East and Central Asia

Regional Economic Outlook: Trade-Offs Today for Transformation Tomorrow

April 2021

A year into the coronavirus (COVID-19) pandemic, the race between vaccine and virus entered a new phase in the Middle East and Central Asia region, and the path to recovery in 2021 is expected to be long and divergent. The outlook will vary significantly across countries, depending on the pandemic’s path, vaccine rollouts, underlying fragilities, exposure to tourism and contact-intensive sectors, and policy space and actions. Public gross financing needs in most emerging markets in the region are expected to remain elevated in 2021–22, with downside risks in the event of tighter global financial conditions and/or if fiscal consolidation is delayed due to weaker-than-expected recovery. 2021 will be the year of policies that continue saving lives and livelihoods and promote recovery, while balancing the need for debt sustainability and financial resilience. At the same time, policymakers must not lose sight of the transformational challenges to build forward better and accelerate the creation of more inclusive, resilient, sustainable, and green economies. Regional and international cooperation will be key complements to strong domestic policies.

Regional Developments and Outlook

Government Debt and Financing Legacy Risks from the Pandemic

Stats

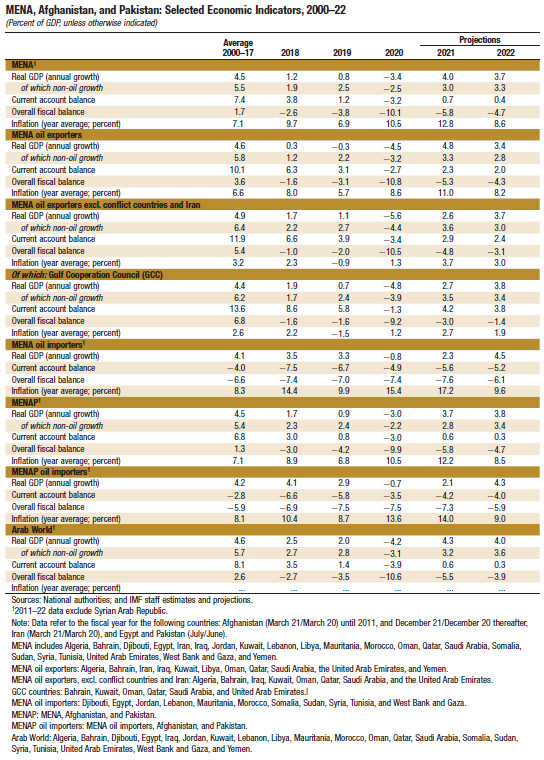

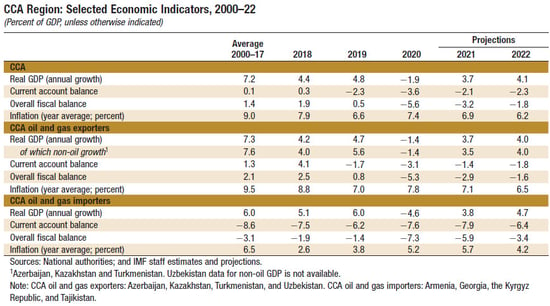

The following statistical appendix tables contain data for 32 MCD countries and territories. Data revisions reflect changes in methodology and/or revisions provided by country authorities.

A number of assumptions have been adopted for the projections presented in the April 2021 Regional Economic Outlook Update: Middle East and Central Asia. It has been assumed that established policies of national authorities will be maintained, that the price of oil1 will average US$52.64 a barrel in 2021 and US $50.07 a barrel in 2022, and that the six-month London interbank offered rate (LIBOR) on U.S.-dollar deposits will average 0.3 percent in 2021 and 0.4 percent in 2022. These are, of course, working hypotheses rather than forecasts, and the uncertainties surrounding them add to the margin of error that would in any event be involved in the projections. The 2021 and 2022 data in the tables are projections. These projections are based on statistical information available through late March 2021.